This past week, interest rates edged higher in anticipation of a critical week for financial markets. Let's break down what happened and preview what's ahead.

"Everybody's looking for something" – Sweet Dreams by the Eurythmics

Tariff Uncertainty

Financial markets continue to wrestle with uncertainty surrounding forthcoming U.S. tariffs on foreign goods. Questions linger about which countries and products will be targeted, the tariff rates, and their ultimate impact on the U.S. economy and inflation. Last week, Fed Chair Jerome Powell suggested that any inflation sparked by tariffs would be "transitory"-a word that raised eyebrows, given its misuse to describe the persistent inflation of 2021 and 2022. More clarity is imminent: on April 2nd, tariffs are expected to hit a range of countries and products.

Stocks and Bonds: A Shifting Dynamic

Historically, falling stock prices were thought to coincide with declining interest rates. Recently, that relationship has broken down. Despite a sharp stock market sell-off in recent weeks, the bond market failed to rally, disappointing those hoping for lower rates. This past week, stocks appeared to stabilize, but bond prices dropped, pushing yields higher.

Debt: A Global Headwind

Government debt, both domestic and international, remains a major obstacle to meaningful rate improvement. Here at home, the U.S. Treasury sold billions in shorter-term bonds this week. The auction's lukewarm reception did little to ease rates. Across the Atlantic, bond yields in the UK and Germany spiked as markets fretted over new spending and fiscal packages. Rising global yields continue to exert upward pressure on rates here.

Mortgage Applications Surge

Despite a modest rate uptick this week, 30-year mortgage rates have steadily declined since mid-January, when they topped 7%. This drop triggered a significant increase in mortgage applications for both purchases and refinances. One major bank reported an 80% jump in applications between January and March as consumers capitalized on lower rates.

30-Year Mortgage Rates

The 30-year fixed rate mortgage averaged 6.65% as of March 27, 2025, down from the previous week when it averaged 6.67%.

The 4.20% Barrier

The 10-year Treasury Note, a key driver of mortgage rates, has struggled to break below its 4.20% yield support level. That resistance held firm, and the yield has since climbed to 4.35%. For mortgage rates to drop significantly, the 10-year needs to sustain a move below 4.20% for multiple days.

Bottom Line: After improving from mid-January to mid-March, interest rates have ticked up slightly amid ongoing uncertainty. Further declines may hinge on tariff clarity and the Fed's decision to pause Quantitative Tightening next week.

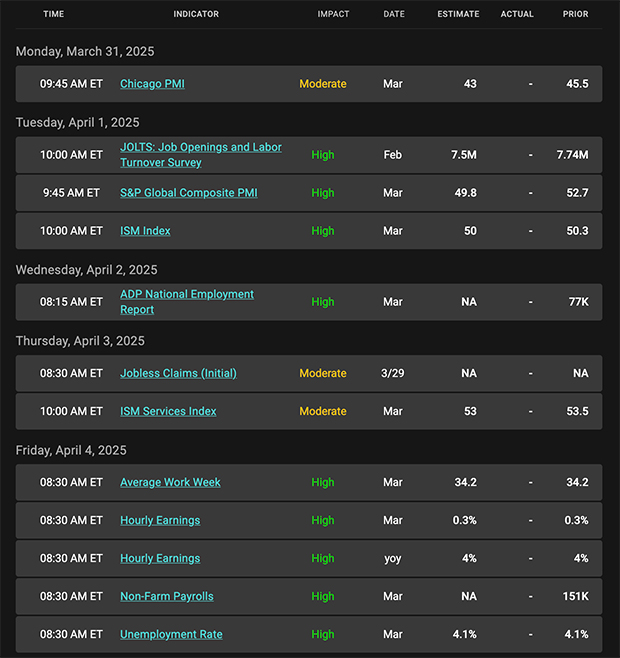

Looking Ahead

Next week promises to be a big one for markets. Key economic data, like the JOLTS report (tracking job openings, hires, and quit rates), will provide insight into labor market trends. On April 1st, the Fed is expected to pause its balance sheet reduction, halting Treasury sales and potentially spurring purchases of Treasuries or mortgage-backed securities. Then, on April 2nd, U.S. tariffs will roll out globally-though details on targets, products, and rates remain unclear, as does the market's reaction. |